The process of filing returns is lengthy and can be quite intimidating for the people who are not from commerce background and do not understand their technical terms. One such very popular term in the world of the Taxation is Book Identification Number which is usually known as BIN. Now, there are many questions related to BIN like what is BIN view ? How does it work? And, from where to check BIN? In this article, we will discuss all the aspects of Book Identification Number (BIN).

Let’s start from scratch and understand how BIN is generated and what does it do. Firstly, DDO (Drawing and Disbursing Officer) creates an AO account of an individual or organization in the Tax Information Network of Income Tax Department by entering their respective details. After that, as a part of the TDS filing which is done through the e-TDS process, a form called Form no. 24G is filled. After the completion of the form, a unique number called Book Identification Number is generated. Now this Book Identification Number consists of the following information:

Receipt Number: It’s a 7 digit unique number corresponding to each for 24G which is TIN accepted.

DDO Serial Number: It’s a 5 digit unique DDO number generated against each Form 24 with a valid TAN.

Date: Consists of the last date for which TDS is reported in Form 24.

As per the Government norms, for every individual who pays TDS, it’s mandatory to mention BIN on their TDS Statements. A TDS statement without BIN is considered incomplete; therefore such returns are usually rejected. Now that we know the significance of Book Identification Number as a part of Taxation, we’ll learn about its important aspects like viewing and downloading the BIN.

BIN View – Steps You Need to Know for NSDL BIN:

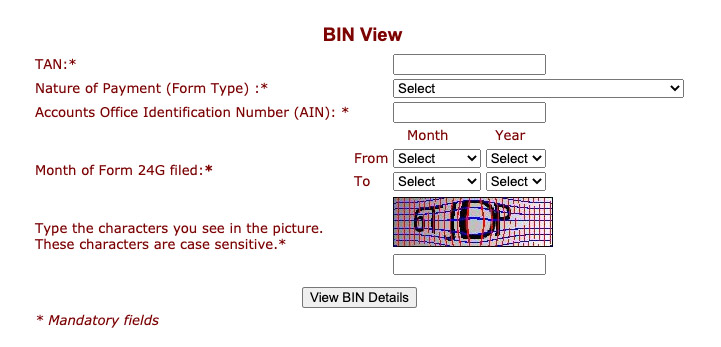

1. Log in to the online portal of NSDL Tax Information Network using the following link:

https://onlineservices.tin.egov-nsdl.com/TIN/JSP/etbaf/ViewBIN.jsp

2. After the login, there will appear a link for verification of BIN Number and after clicking that, you will have to go through a few steps to verify your BIN.

3. On the next page, the process to download the BIN starts. There will a series of information that you need to enter to view/download BIN. These information’s like, TAN Number, the duration for which BIN is required needs to be entered here.

4. Then appears an option called, Nature of Payment, under this tab there are multiple forms for the type of payment for your TDS. For example, to avail TDS on your salary, you need to fill form 24Q, for TDS against non-salary there is a form called 26Q, and for TDS returns for non-residents there is a different form called 27Q.

5. The next page will be BIN Verification page wherein a couple of details regarding BIN amount is to be entered.

6. After filling the details in verification form, there will appear a few checkboxes that you need to check and finally click on “Verify Amount” to view your BIN.

7. Your BIN Verification Number along with a compressed BIN file will appear on the screen.

All You Need to Know About BIN View:

● BIN is generated only for DDO records against a valid TAN.

● A user can view BIN for a maximum period of 12 months.

● There appears a step called verification of the amount of tax paid to Government, which is optional. To verify the tax, AO has to select the checkbox and provide the tax.

● BIN will appear in compressed file format.

● The file will be password protected.

● Passport for BIN file is usually 7 digits AIN Number.

● The file will contain all DDO records matching to the TAN given.

● If the data exceeds the limit, the file is split into multiple small files.

BIN View Conclusion:

After filling Form 24G for monthly e-TDS, a unique number against your DDO record appears, this number is called Book Identification Number (BIN). BIN has been made mandatory for all the taxpayers who are reporting TDS. A TDS statement without BIN is considered invalid and such applications are rejected.

Viewing/downloading BIN is a pretty simple process. All you have to do is log into your AO account on NSDL tax Information Network Portal and follow a series of steps for verification of BIN. After completion of this process, a compressed file with all the information regarding your BIN for a particular duration or TAN is generated.