The Indian Financial System is an important part of the economic development of our country. It manages the flow of funds between the people (household savings) of the country and the ones who may invest it wisely (investors/businessmen) for the betterment of both parties. The Indian financial system can be broadly classified into two categories:

1) Banking System

2) Non-Banking Financial Institutions

We’ll learn the following Topics in Module A.

1. Indian Financial System – An Overview

2. Banking Regulation

3. Retail Banking, Wholesale, and International Banking

4. Role of Money Markets, Debt Markets & Forex Market

5. Role and Functions of Capital Markets, SEBI

6. Mutual Funds & Insurance Companies, Bancassurance & IRDA

7. Factoring, Forfaiting Services, and Off-Balance Sheet Items

8. Risk Management, Basel Accords

9. CIBIL, Fair Practices Code for Debt Collection, BCSBI

10. Recent Developments in the Financial System

Indian Financial System – An Overview

What is a Financial System?

A financial system is a set of institutions, instruments, rules, procedures, and regulations that together determine how financial services are provided in an economy. These services include:

1) Access to capital – including debt and equity capital

2) Payments and settlements – including cheques, credit cards, and digital payments

3) Investment management – including mutual funds, pensions, insurance, and other investment products

4) Risk management – including the regulation of banks and capital markets to prevent systemic risks such as market crashes

The Indian Financial System plays an important role in supporting economic growth by providing access to funding for investors and businesses, facilitating the efficient movement of funds between savers and borrowers, and helping individuals manage risks related to their finances. It is also responsible for ensuring that financial transactions are conducted safely and efficiently, while also promoting financial inclusion by ensuring that everyone has access to basic banking services like savings accounts, credit cards, loans, etc.

|

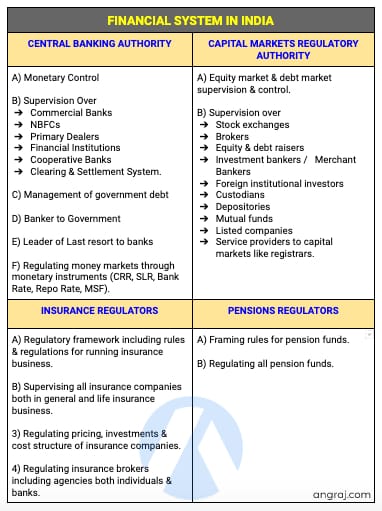

FINANCIAL SYSTEM IN INDIA |

|

|

CENTRAL BANKING AUTHORITY |

CAPITAL MARKETS REGULATORY AUTHORITY |

| A) Monetary Control

B) Supervision Over

C) Management of government debt D) Banker to Government E) Leader of Last resort to banks F) Regulating money markets through monetary instruments (CRR, SLR, Bank Rate, Repo Rate, MSF). |

A) Equity market & debt market supervision & control.

B) Supervision over

|

| INSURANCE REGULATORS | PENSIONS REGULATORS |

| A) Regulatory framework including rules & regulations for running an insurance business.

B) Supervising all insurance companies both in general and life insurance business. 3) Regulating pricing, investments & cost structure of insurance companies. 4) Regulating insurance brokers including agencies both individuals & banks. |

A) Framing rules for pension funds.

B) Regulating all pension funds. |

Commercial banks:

Indian financial system is dominated by commercial banks which account for more than 60 percent of the total financial system. Indian banking sector is classified into two types – scheduled and non-scheduled banks. Scheduled banks are those which have been included in the second schedule of RBI Act, 1934. As on March 31, 2020, there were 27 public sector banks (PSBs), 21 private sector banks, 43 foreign banks, 56 regional rural banks (RRBs), 1,594 urban cooperative banks (UCBs) and 94,384 rural cooperative banks (RCBs) in India.

Non-Banking Financial Companies (NBFCs):

One of the key components of India’s financial system is the non-banking financial company (NBFC). As the name suggests, NBFCs are companies that provide a variety of financial services but do not fall within the purview of traditional banks. Unlike banks, which are regulated by the central bank in India, NBFCs are licensed and regulated by the Reserve Bank of India (RBI).

NBFCs play an important role in Indian financial markets, serving as intermediaries between savers and borrowers. They are able to provide capital to small businesses and individuals that may not have access to traditional banking services, thereby helping support economic growth and development.